IRS Transcript Online – Filing your tax return each year is important, and so is saving your IRS transcript online. Whenever you file a tax return and it gets accepted by the Internal Revenue Service, they will generate an IRS transcript so that you can use it whenever you require it.

Regularly people do not require their IRS transcript, but sometimes it can become necessary for you to obtain that. In case you require a mortgage or student loan, you have to present your IRS transcript online to get approved.

Today we will discuss how you can easily obtain your latest IRS transcript online. At the same time, we will also discuss the types, both transcript and the right uses of the same. So without wasting any more time, let’s get started.

Types of IRS Transcript Online

Before we move ahead and talk about other things related to the transcript, let’s take a look at all the types of IRS transcripts online.

Yes, there are several types of IRS transcripts available online, and you have to specify whenever you are requesting them.

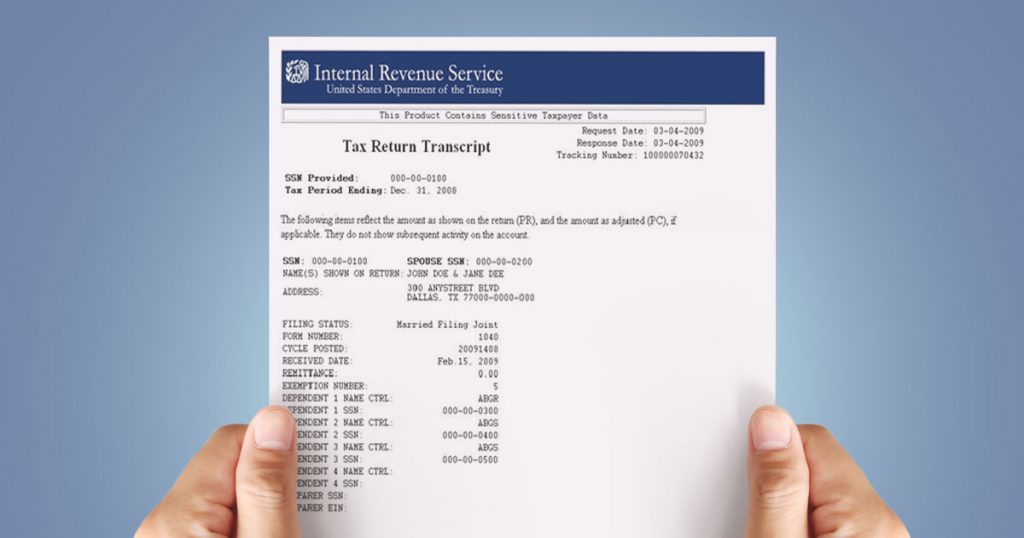

Tax Return Transcript

A tax return transcript is among the most important and common types of IRS transcript online issued by the Internal Revenue Service. This type of transcript is going to contain everything from your original form 1040 series.

The transcript is also going to contain the most important lines of your tax returns, such as adjusted gross revenue from your original tax return. There is only one limitation with the tax return transcript is that it is not going to show any changes you made after you have filed your original return.

Tax Account Transcript

The second most important and popular IRS transcript online is the text account transcript. It is going to show all the basic data such as type of return, your marital status, adjusted gross revenue, and your total taxable income.

The Internal Revenue Service has a feature where you can easily request a tax account transcript as old as up to 10 years. At the same time, it is also going to show any changes you made in your original return.

Wage and Income Transcript

Another most common transcript is wage and income transcript. This type of transcript is going to show the details Filled in forms such as W2, 1099, 1098, and 5498. You can simply request a wage and income transcript using form number 5406- T. It is also available as old as ten years.

Other Types

Apart from the above-given types, there are some other IRS transcripts. These transcripts are also equally important, and you might require them for different reasons.

For example, Internal Revenue Service issues where verification of non-filing letters. The letter is going to contain information and proof that the Internal Revenue Service does not have any record of filled forms such as 1040, 1040 A, etc.

Lastly, the Internal Revenue Service also issues a record of account transcripts. This type of transcript is among the least popular types of transcript offered by the Internal Revenue Service. It is the combination of X account transcript and tax return transcript.

Order your IRS Transcript Online

Now, let’s take a look at how you can easily use the website of the Internal Revenue Service to order your IRS transcript online.

Even though the Internal Revenue Service allows you to order your IRS transcript using different ways, we are going to use their official website. The Internal Revenue Service has already introduced an online portal where you can easily request an IRS transcript online.

- First of all, you have to click on the above-given button, which will directly take you to the official website of the Internal Revenue Service.

- The button will also redirect you directly to the Get your tax report page.

- You can scroll a little bit down and find the option named get your transcript online.

- You simply have to click on the button and enter using the existing IRS username and password.

- Once you have successfully logged in, you will find the option named to get my tax records.

- In this option, you will find all the different types of transcripts, and you can download or request them depending on your needs.

IRS Transcript and Original Return

A lot of people get confused at first, and they are not able to differentiate between their original tax return and IRS transcript.

There can be some situations where your needs are not going to be fulfilled by the IRS transcript, and you have to use a Xerox copy of your actual return.

If you are also one of those people who are looking to get a Xerox copy of your actual return, then you are at the right place. If you have filed your tax returns by yourself, then you have to fill out a form named IRS 4506 and mail it to the office of the Internal Revenue Service.

While sending your request, you also have to attach a 43-dollar fee. The service is not afraid to use, and the Internal Revenue Service might take up to 75 days to process your request for a Xerox copy of your actual return. We will request you to have some patience as the process is going to take a little bit longer time.

Can I order an IRS transcript by mail?

Yes, the Internal Revenue Service has an option where you can easily request your IRS transcript online or by mail. A lot of people are still using offline methods in the United States to deal with the Internal Revenue Service. That is why the Internal Revenue Service has not discontinued its offline services.

Which is the best model to order IRS transcripts online or offline?

Both modes are best, and you can request your IRS transcript online or offline. If you are capable of ordering your transcript online, we will suggest you go for digital methods as it is faster and more reliable. If you order your transcript using an offline method, then you might not receive it on time, or it may get lost in the mail.