Where Is My Tax Refund – Income tax is among the biggest sources of income for any government around the world. Even in the United States, every person who is working has to pay income tax on their total annual income.

Keeping that in mind, the federal government of the United States launched a department named Internal Revenue Service to collect the annual income tax depending on the income of a person.

It’s been more than 150 years since Americans have been paying income tax, and it has been helping the federal government to develop the nation. The Internal Revenue Service is not here to suck out the money from every general American.

The Internal Revenue Service also launched several programs where the IRS is going to refund the taxes paid by the taxpayer. Those who are new to tax-paying or getting a tax refund for the very first time can find it very hard to track that refund. Today, we will discuss everything related to tax refunds, and after that, you won’t have to search for where my tax refund is on any platform.

Check your tax Refunds.

The first thing you should do right now checks your tax refunds. The federal government of the United States or the Internal Revenue Service is only going to issue refunds if a person has already failed his tax return successfully.

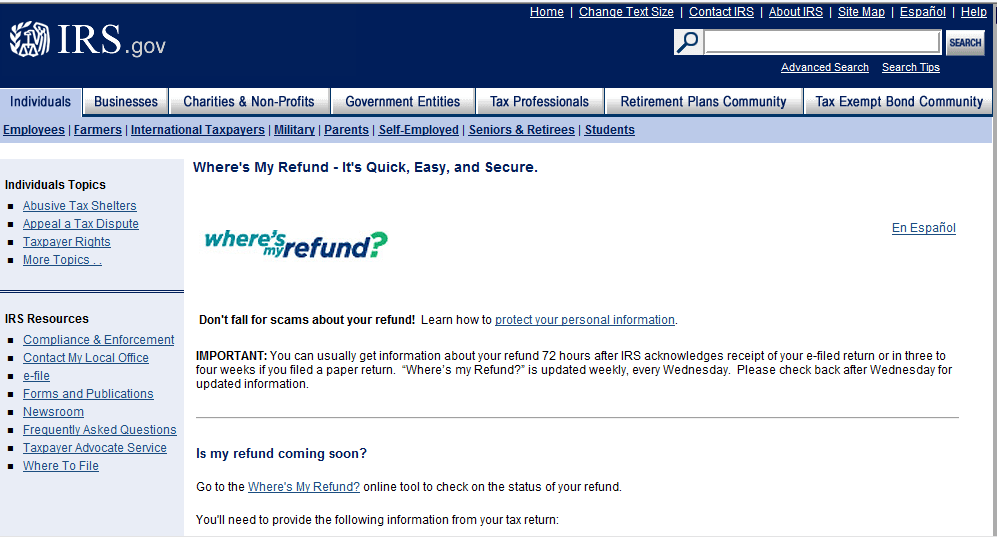

You will require a few things to track your refunds. On the official portal of the Internal Revenue Service, you might have to fill in your Social Security number, filing status, and the exact number of dollars you are looking for as a refund.

You can click on the above-given button, which will directly take you to the official website of the Internal Revenue Service and redirect you to the refund status page. On this refund status page, you have to fill in everything asked by the IRS.

Types of tax refunds this year

The second thing you can do right now is look for the Going to get. In case you are not eligible for any refund, and you have asked the Internal Revenue Service to issue that refund, then there is a probability that you will never receive that refund.

Soon after the COVID-19, the types of refunds increased in the United States, and nowadays, there are so many things you should track. First of all, people who have already overpaid their taxes can get refunded.

Secondly, parents might also be eligible to receive a child tax credit from the federal government of the United States as they announced that the government is going to release around 3600 U.S. dollars per child.

At the same time, the federal government is also going to issue reimbursements for the money you spend on childcare-related expenses.

Lastly, A lot of people did not receive their third stimulus payments this year, and they are also eligible to receive a tax credit.

Reasons you have not received your tax refund.

The Internal Revenue Service has mentioned on its official website that there could be several reasons for you not receiving your tax refund. We will try to discuss major reasons, but there can be hundreds of different reasons.

Not qualified

A lot of people in the United States fill their tax returns by themselves, and it can become very difficult if the government changes something in the rules. If you are not up to date with every update of the Internal Revenue Service, then there is a probability that you might ask for tax refunds for which you do not qualify. First of all, you should check your eligibility for those tax refunds.

Error in tax Return

Another popular reason for you not receiving any tax refund could be related to an error in your tax returns. The Internal Revenue Service has already made it clear that you must submit your tax return successfully to get qualified for any tax refund.

If your tax return has any error and it has been rejected by the Internal Revenue Service, then you might not receive your tax refund.

Need further review

Sometimes your tax return might require further review from officials of the Internal Revenue Service. In those cases, even if you qualified for the tax rate fund, you might not receive it as early as you thought.

Child tax credit

Recently, the Internal Revenue Service stated child tax credits and people receiving tax refunds. As per the statement, those who have applied for a child tax credit might have to wait a little bit longer as the Internal Revenue Service is going to issue these tax credits a little bit longer than you expected.

When to contact the Internal Revenue Service for your tax refund?

At last, the Internal Revenue Service has asked everyone to have some patience when they are expecting tax refunds. Your tax refunds are not going everywhere, and under any circumstances, you will receive those refunds.

In case you do not receive your tax refunds due to any mistake from the department, then you are eligible to receive interest on your tax refund.

People who use electronic devices to file their income tax returns should wait at least 21 days before they call the Internal Revenue Service for their tax refunds. The IRS has also suggested everyone use the where’s my refund tool before they contact the department.

You should only use the official website of the Internal Revenue Service to find out the numbers of support centers. Kindly do not use calls on numbers you found on some third-party websites.

My tax return was accepted successfully, but where is my tax refund?

The Internal Revenue Service has already made it clear that if your tax return has been accepted successfully, then you should wait for at least 21 days before you do anything regarding your tax refund. In case you do not receive any refund even after 45 days, you are eligible to receive an interest payment on your tax refund. You can try to contact the Internal Revenue Service regarding your tax refund status, but you should only use the official numbers.