IRS Stimulus Tracker

IRS Stimulus Tracker – A deadly virus hit the world and the United States in early December 2019. The virus was first discovered in Wuhan, China, and later spread worldwide. By 2022, there will be no country in the world without coronavirus. In the first global hit, several countries imposed lockdowns to prevent the spread of the new coronavirus. As you know, it is not enough, but the lockout hit the poor and middle class of the economy. Similar things are happening in the United States of America. Many people struggle on a daily basis to pay off their debts or even to buy food. Unlike the rest of the world, the United States federal government has come up with a trillion-dollar economic recovery plan. The government has announced that it will send thousands of dollars to every qualified person in the United States.

How to Track IRS stimulus?

To date, the Internal Revenue Service has issued three stimulus checks to all eligible individuals in the United States. But if you’re interested in stimulus control, then you’re in the right place. You can use the IRS incentive tracker to track your payment.

Get my payment

Getting my payment tool is the first way to track IRS incentive payments. You can click on the link below to go directly to my payment page on the official website of the Internal Revenue Service.

Get my payment Make sure you have your social security number, date of birth, and postal address used on your tax return to track your incentive payment. If you do not meet these requirements, the tool will not display the details.

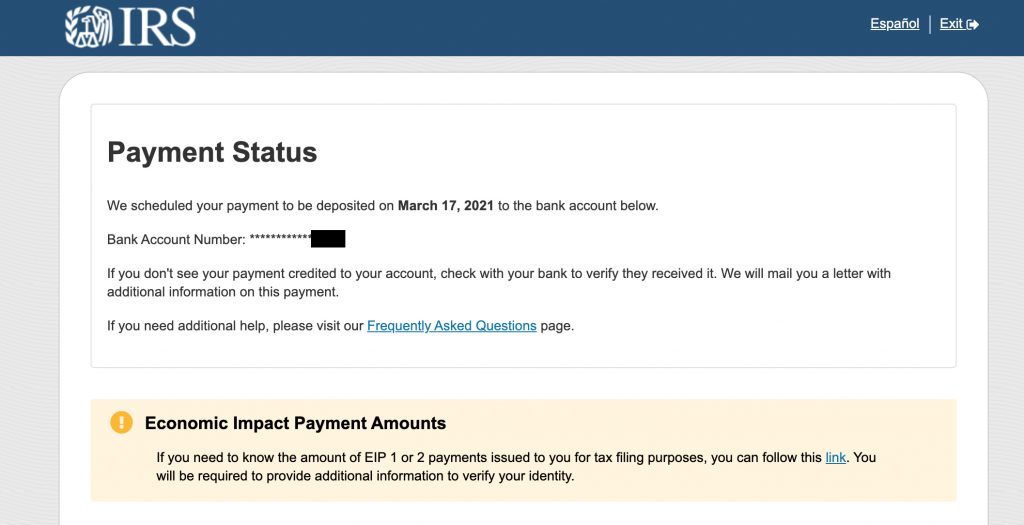

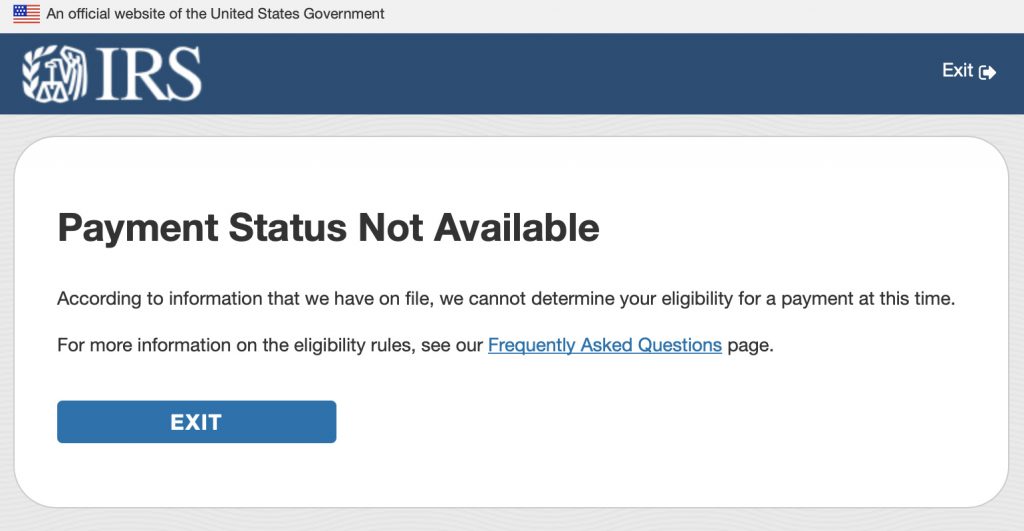

IRS Stimulus Tracker IRS Stimulus Tracker When you enter transaction details, you will receive one of three messages, Payment Status, Additional Information Required, and Payment Status Not Available. If you have successfully received an incentive payment, the message will show the date and time the payment was sent to you. In addition, if you are eligible and do not receive it, the tool will tell you that the payment date is not yet available.

After entering the information, if you need more information, it means that the Internal Revenue Service issued your incentive payment but returned it to the IRS because the post office could not provide it.

In this case, you will need to enter your bank details before the next issue. The process is very easy and you can do it in seconds. Finally, if it has a payment status that is not relevant, it means that the Internal Revenue Service will not process your payment because you are not eligible for payment.

If you think you are eligible for an incentive payment, you can continue to check the space every day.

Online account

IRS Stimulus Tracker IRS Stimulus Tracker Online account The Internal Revenue Service has now successfully issued all three economic impact payments and you can now easily review them using your Internal Revenue Service online account. Click the button below to go to the official website of the Internal Revenue Service. Butter also takes you to an online account page where you can easily sign up and track your IRS incentive payments.

Online IRS account This is the same account you can use to access all of your tax records. Along with other information, it also has information about your payments for economic impact. You can also review digital copies if you receive a notification.

The Internal Revenue Service issued three different economic impact payment notices.

- Notice 1444: shows the first economic impact payment sent for the tax year 2020

- Notice 1444 B: shows the second economic impact payment sent for the tax year 2020.

- Notice 1444 C: This shows the third economic impact payment sent for the tax year 2021.

Recovery Rebate Credit

When the US federal government first issued the stimulus payment, it also introduced another online tool that non-tax entities can use to provide information to the IRS to process the payment. However, this tool was not available to assess the second and third stimuli.

So if you didn’t file a tax return for 2019 and 2020, you should use the credit claim tool on your 2020 return. In addition to non-tax filing, if you think you’re eligible and didn’t receive your incentive payments or received less than you expected, you can claim a refund by filing your 2020 tax return.

If you have already completed a tax return for 2020, you can change it. A debt collection rebate can reduce the amount of taxes you owe to the federal government, or you may even get a tax refund. Please remember not to use your 2020 tax return to claim your missed first or second payment.

If you did not receive incentive payments for the third economic impact payment or received less than the total amount, you will be eligible to repay the credit in 2021.

Note that the first and second incentives should only be earned with the 2020 Recovery Credit and the third incentive payment of the 2021 Recovery Credit.

Takeaway

After the first hit by the novel coronavirus in 2019, the US federal government did everything possible to prevent the spread of the virus. The government also provides free financial assistance to any eligible person in the United States. We discussed two IRS stimulus trackers. You can use one depending on availability. The Internal Revenue Service recently announced that they will disconnect my payment tool from their official website. So far, they’ve released all three economic impact payments to all eligible Americans, but if you don’t receive incentive payments or receive less than you expected, you may be eligible for the credit. You can use the credit discount to collect, so all three incentive payments if you don’t receive them. Please note that you must use the rebate credit set up on your 2020 tax return for the first and second payments, and you must use your 2021 tax return for the third payment.