IRS Installment Agreement – Income taxes are among the biggest earning sources for any government around the world. Most governments try to increase as much as possible taxes to increase their earnings. Money earned from taxes can be further invested in various government programs and subsidies for the overall development of the country.

To collect the income tax and create policies related to income tax, governments around the world have created their organizations. In the United States, it is known as the IRS. IRS is also known as Internal Revenue Service.

Kindly do not take taxes in the wrong way, as the government does not have many sources of income. At the same time, they have to do a lot of welfare work to uplift every citizen of the country. The government, along with the Internal Revenue Service, tried to uplift your life by providing you with several services. Today, we will discuss the IRS installment agreement and try to understand how you can take advantage.

What is the IRS installment agreement?

As you are aware, everyone has to pay taxes on their income. It is not only you who is struggling to pay your income tax each year. A lot of people like you who are earning a lot of money are also struggling to pay their taxes to the Internal Revenue Service.

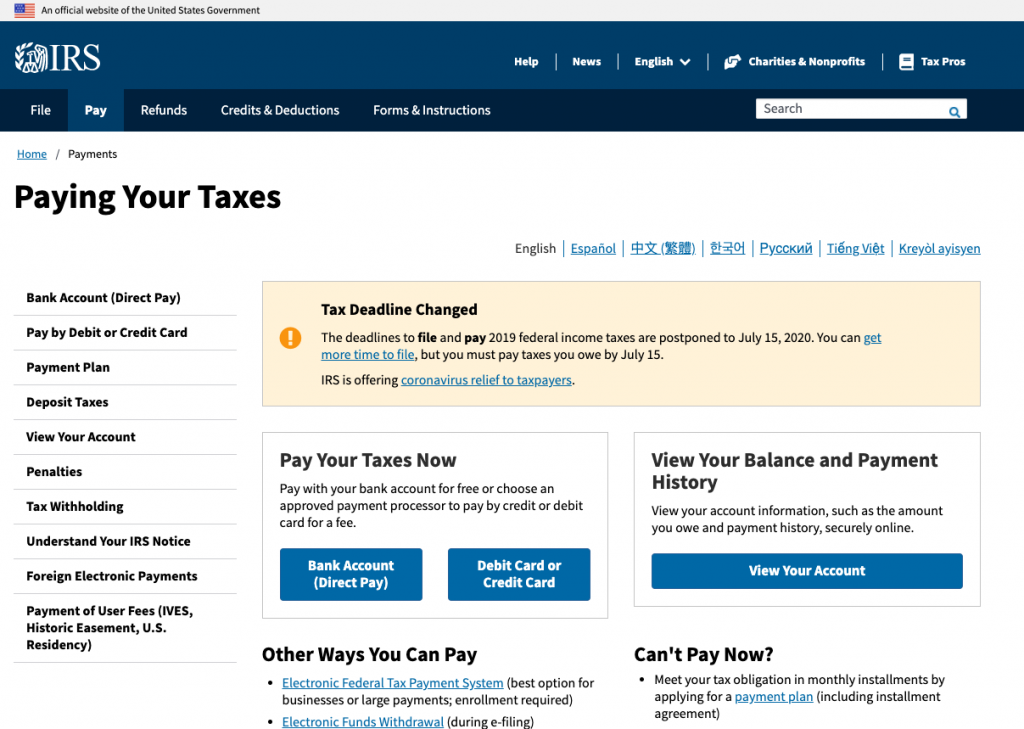

Due to various reasons, a lot of people are not able to pay their taxes as they should. That is why the Internal Revenue Service came up with that monthly installment plan so that anyone can easily pay off any large debt to the Internal Revenue Service.

You can consider the IRS installment agreement as an extended time frame to pay the pending taxes. You can request an IRS installment agreement anytime to pay the payment.

What are the charges for the IRS installment agreement?

Before we discuss anything else related to the IRS installment agreement list, first discuss the charges to opt for no service. As you are trying to pay off your debt, it will be foolish if you get more debt just to pay your previous debts.

Short-term payment plan

There is something called a short-term payment plan launched by the Internal Revenue Service for all the text Bing individuals in the United States. It is not necessary that you have to opt for an IRS installment agreement if you are not able to pay your pending taxes at the final deadline.

The Internal Revenue Service has a simple option for all individual taxpayers who are not able to pay their taxes on time. Before you default or you exceed the final deadline in fulfilling your text commitments, you can request a short-term payment plan.

The short-term payment plan is for individuals only, and you will get 180 days to pay your debt. The time frame can vary depending on your previous history or the amount, but there is a way for all individual taxpayers.

Charges

Now, back to the charges for the IRS installment agreement. Yes, there are some charges which you have to pay if you opt for an IRS installment agreement apart from your pending debts.

The Internal Revenue Service might charge $31 for the setup or $130 depending on the option you are going to select for the IRS installment agreement. The first option is known as a direct debit installment agreement, and you have to pay around $31 for the setup only if you apply online.

On the other hand, the second option it’s going to cost you around $130 only if you apply online. The major difference between the short-term payment plan and the IRS installment agreement is that individuals have to pay the full amount of pending taxes in the short-term payment plan. On the other hand, individuals can pay in regular intervals with an IRS installment agreement.

What are the eligibility criteria for an IRS installment agreement?

The Internal Revenue Service has specific eligibility criteria for every individual and business in the country for IRS installment agreement. You must be following that specific eligibility criterion to be qualified for an IRS installment agreement.

If you are an individual and you owe no more than $10,000 to the IRS, then you will be eligible for an IRS installment agreement if you follow the below-given criteria.

In case you give $10,000 to the Internal Revenue Service as taxes, then you might have to provide some information regarding your finances to the department.

- You must not have filed a late return or paid late in the previous five years.

- You must agree to file on time and to pay on time in future taxes.

- You must agree to pay the amount you or pay within three years.

- You must not have any open bankruptcy proceedings.

What is the procedure if a person is not able to pay IRS installments as per the agreement?

Usually, people do not opt for an IRS installment agreement as the Internal Revenue Service officers will review everything starting from your income to all the way liabilities.

The Internal Revenue Service only allows an IRS installment agreement if a person is not doing well financially at the time of the taxes. If a person is not able to pay the installment as per the IRS installment agreement, then they should contact the IRS as early as possible.

There is a probability that you might experience unexpected financial setbacks if your financial situation turns out to be worse than you thought and estimated by the IRS officials.

The Internal Revenue Service officer might be able to reduce your monthly payment even further depending on your financial situation. Apart from that, you can always seek the advice of a federally-authorized tax professional.

What is the maximum time frame with the IRS installment agreement?

The Internal Revenue Service has two different plans, and as per those plans, you can select three years if you owe less than 10,000 to the IRS and six years if you owe up to $50,000. Apart from that, the IRS installment agreement time frame is going to depend on how much you owe and what your income status is.